The 14 Money SECRETS School Failed to Teach You

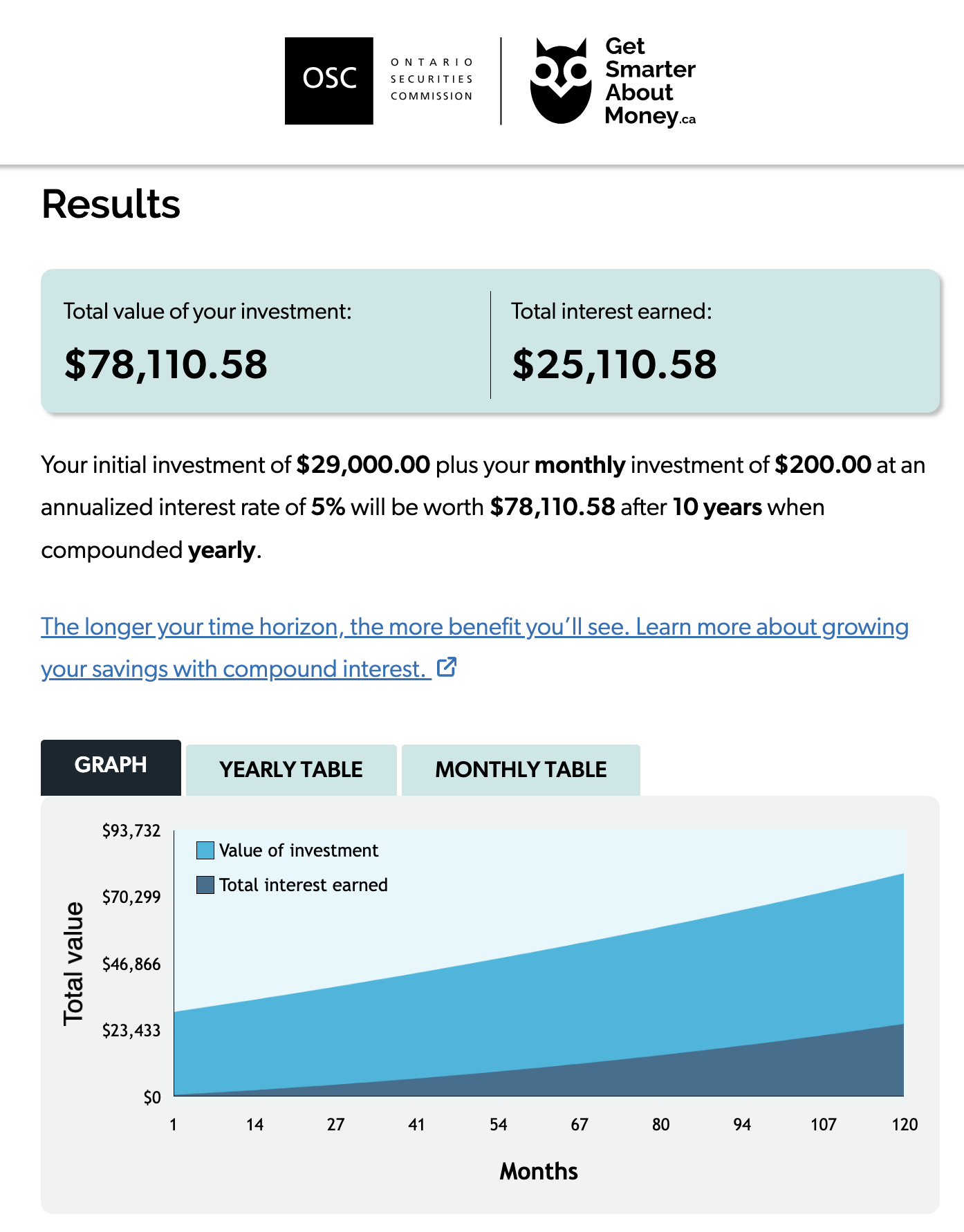

If you like money, listen up! Let me start by saying that I grew my daughter's investment account from $0 to $29,000 in just 5 years by simply putting away $200 a month. At this rate, by the time she turns 15, she’ll have about $78,000 if we assume a conservative 5% average annual rate of return. (Check out Get Smart About Money’s Compound Investment Calculator to see how you’re investments will do over time)

For the most part of my life, I HATED reading with a passion. Every book I picked up would put me to sleep in 5-10 minutes and I found it so hard to concentrate on the content, especially on a bright sunny day… if you can relate, comment “ME TOO” below.

In recent years, I’ve found a greater purpose bigger than myself for becoming a hyper learner and whatever piece of content I pick up, I can absorb it like a sponge.

I truly think having a higher purpose greater than yourself is a crucial part of achieving any goal… but that’s for another post.

Today, I’d like to share with you The 14 Money SECRETS School Failed to Teach You derived from Morgan Houzel's book, Psychology of Money that will help you make better decisions with your money. But I guess it’s true when they say, better late the never! So learn from my mistakes so you don’t have to make them yourself. Here we go!

1. Be humble when things go right and forgive/be compassionate when things go wrong

When judging both yourself and others, it behooves you to respect the power of luck and risk - which are both real and hard to identify. This way, you’ll also increase your chances of finding good role models.

2. Put ego aside and build wealth

Saving money is the gap between your ego and your income. Real wealth is determined by your ability to forgo the shiny things you can buy today and avail yourself of the multitude of options and opportunities in the future. No matter how much you earn, you’ll never build wealth unless you get a grip on how much you save.

3. Invest in a way that helps you to sleep at night

You would be doing yourself a favour if you focused on strategic ways to invest your money to get better sleep. If you’re an early investor like I was, you’re probably checking your investment account every 5-10 mins. This is NOT an healthy habit and I remember celebrating the 3-5% gains and then feeling like it was the end of the world when the market went down by 6-10% (which is very common by the way) As you zoom out to see a 5-year investment progress report, the gains feel great, but when you zoom into each year and see how jagged those dips are every month, they feel like millions of knives cutting at your heart. I wish I learned how to create an all-weather portfolio like I have now where I can do the George Foreman “Set it and forget it” principle. Dang..I think I just dated myself there…

4. The single most powerful thing for any investor is the time horizon

It’s how little things grow. It’s also how big things fade away. It won’t neutralize luck and risk but it will bring you as investors closer to what you deserve. For those Canadians with kids out there, a great example of this would be the Registered Education Savings Plan which is complemented by government grants. There's this financial hack called Front loading that not many people know about that could result in a difference of 10s of thousands of dollars in tax-free savings... I have already doubled my daughter's capital investment of about 12,500 to 25,000 at the time of this recording in just 5 years! If this topic interests you, leave a comment below and maybe I'll make a fun video on how I did it. A great quote from the infamous Charlie Munger that I love is "I did not intend to get rich. I just wanted to get independent"

5. Learn how to be OK with things going wrong

You can be wrong 50% of the time and still make a fortune because a small minority of things account for the majority of the outcomes. (the Pareto Principle of 80/20). It’s completely normal to have a large portion of crappy investments and a few outstanding ones. This is usually the best-case scenario. You can either be the brilliant winner by focusing on the wins or exacerbate the loss and regret by focusing on the losses.

6. Use money to gain control of your time

Not being able to control your time is a powerful and universal drag on one's happiness. Being able to be with who you want, when you want and do what you want is the ultimate reward for any pursuit of financial goals.

7. Be nicer and less flashy

No one cares about your possessions. You might think that a fancy Porsche or BMW will bring you more respect when in reality, people only look at how they would look in your vehicle instead of how cool/rich you look. What you probably really want is respect and admiration of others and you can get these through kindness and humility instead of horsepower and expensive swag.

8. Save - just do it!

You don’t need a goal or reason to do it. Everyone’s life is filled with a slew of unpredictable events and surprises. Saving is your hedge against life’s inevitable setbacks that tend to happen at the worst time possible. Personally, I put away enough funds that sustain my family of 5's living for at least 6 months. How do I calculate this? It's simple really, just take a glance at the total amounts you've spent in the last 3 months to determine your average monthly spending rate and then times it by 6. I figured out that we spend about 5,000 to live comfortably so I put away 30,000 in a high-interest savings account that is easily accessible if I get into a pinch. Some people I know have 1 month's worth of emergency funds while others have 12 months of emergency funds - just do what’s right for you.

9. Define your cost of success and be ready to pay for it

Just like in life, uncertainty, doubt and regret are common costs in the finance world. Nothing worthwhile comes free in line. It helps to remember that unlike going to the grocery store where everything is labelled and priced clearly, most financial products and costs have invisible price tags that should be part of our decisions but are sadly missed. They usually come in the form of fees, the price worth paying now in exchange for a greater future value instead of fines, and penalties that can be avoided.

10. Don’t discount room for error

What keeps most of us motivated is the difference between what we hope to happen and what we need to have happen to do well. Room for error isn’t simply a conservative hedge, it can also be the difference between giving up completely or deciding to stay in the game. Remember, if you aren’t an active player, you will always lose the game.

11. Avoid the extremes of financial decisions.

DID SOMEONE SAY TO PUT IT ALL ON BITCOIN?! -which is doing VERY at the time of writing this post. It recently hit it’s new all-time high of+90k CAD and lucky for me, I started investing in 2018.

Jokes aside, tell me if this sounds familiar. You or someone you know hits the gym REALLY hard, then stops for a week (or two) recovery and then finds it extremely tough to build up the motivation to get back into the gym again. This type of all-or-nothing mentality is a disaster waiting to happen. As humans, our goals and desires will change over time. And with more extreme past decisions come a higher potential for regret in the future if goals were not attained. Persistence and consistency are key for a sustainable approach to long-term and inevitable success.

12. Risk can be your friend that pays off over time

You've probably heard of more risk, more reward. In terms of investments, this is inherently true however you should make sure you stay away from ruinous risk as this can wipe you out completely and prevent you from taking future risks that will pay off big-time. How do I mitigate risk, I diversify my portfolio into low, medium, high and (may never see that money again) risk levels.

13. Define the game you’re in

There is a big difference between someone who is looking to invest like a day trader vs someone who is building a long-term nest egg for retirement. Here are 4 types of investors that are highlighted in the book and the approach each one should take to achieve their target returns.

Maybe your'e a... 30-year time horizon Young gun - Sober analysis that looks at Google’s discounted cash flow over the next 30 years.

Or maybe a 10 years Cashout - Analyze the tech industry and watch for the potential upswing if Google can manage to execute its vision.

If you're a 1 year and done - Pay attention to Google’s product sales cycles and if there will be a bear market.

Then ther eare the Day traders - Looking to squeeze a few dollars between what happens now and lunchtime which can be accomplished at any price.

Take a moment, and think about it... which one are you? Which would would you like to become?

14. Respect the chaos

Lastly, two people can have vastly different goals and desires, so don’t be surprised if you come across disagreements when talking about finances with others. There is only one right answer, the one that works for you.

Those who think they can simply ‘control your thoughts to control your reality’ or use positive thinking and affirmations to manifest dream outcomes are missing a big piece of the puzzle.

We should always appreciate the power of luck and risk. They are complex at their best! They are also hard to identify and quantify, but it is there nonetheless.

Take Medicine as an example. It's a complex profession, just as much as the interactions between physicians and patients. It is preposterous to think that in the practice of the arts and science physicians can depend solely on their benevolent intentions and personal ability to judge what is right for the patients. Everyone has a different model of the work from which we experience life and we all value different things.

Do you know what other profession is just as complex? Financial Services and Life Coaching. The advisors and coaches don’t know you as well as you do.

I as a coach can simply ask questions to help determine your dream outcomes and intrinsic motivators. However, my clients (and probably you included) are complex beings often swayed by global states and significant emotional events.

So go easy on yourself and get educated to set yourself up for success.

And trust me, if someone like me who HATED reading can do it… so can you!